SaaS Affiliate Program ROI Calculator: Is an Affiliate Program Worth It?

Meta Description: Calculate whether an affiliate program makes sense for your SaaS. Get ROI projections, CAC analysis, and commission recommendations based on your MRR, A…

Meta Description: Calculate whether an affiliate program makes sense for your SaaS. Get ROI projections, CAC analysis, and commission recommendations based on your MRR, ARPU, and customer lifetime metrics.

Target Keywords: SaaS affiliate program ROI, affiliate program calculator, affiliate program worth it, SaaS affiliate economics, affiliate program profitability

Every SaaS founder eventually faces the same question: "Should we launch an affiliate program?" It sounds like a growth unlock—leverage other people's audiences, pay only for results, scale customer acquisition. But is it actually worth your time and money?

The answer depends entirely on your business metrics, commission structure, and realistic expectations about affiliate performance. This calculator helps you cut through the guesswork and see the actual numbers. You'll discover whether an affiliate program makes financial sense for your specific situation, what commission rate you can afford to pay, and what ROI you can realistically expect.

Before you dive into the calculator, gather these key metrics:

- Your current Monthly Recurring Revenue (MRR)

- Average Revenue Per User (ARPU)

- Average customer lifetime in months

- Current Customer Acquisition Cost (CAC)

- Monthly new customer volume

Once you have these numbers, the calculator will show you projected affiliate revenue, commission costs, effective affiliate CAC, and 12-month ROI projections. Let's get started.

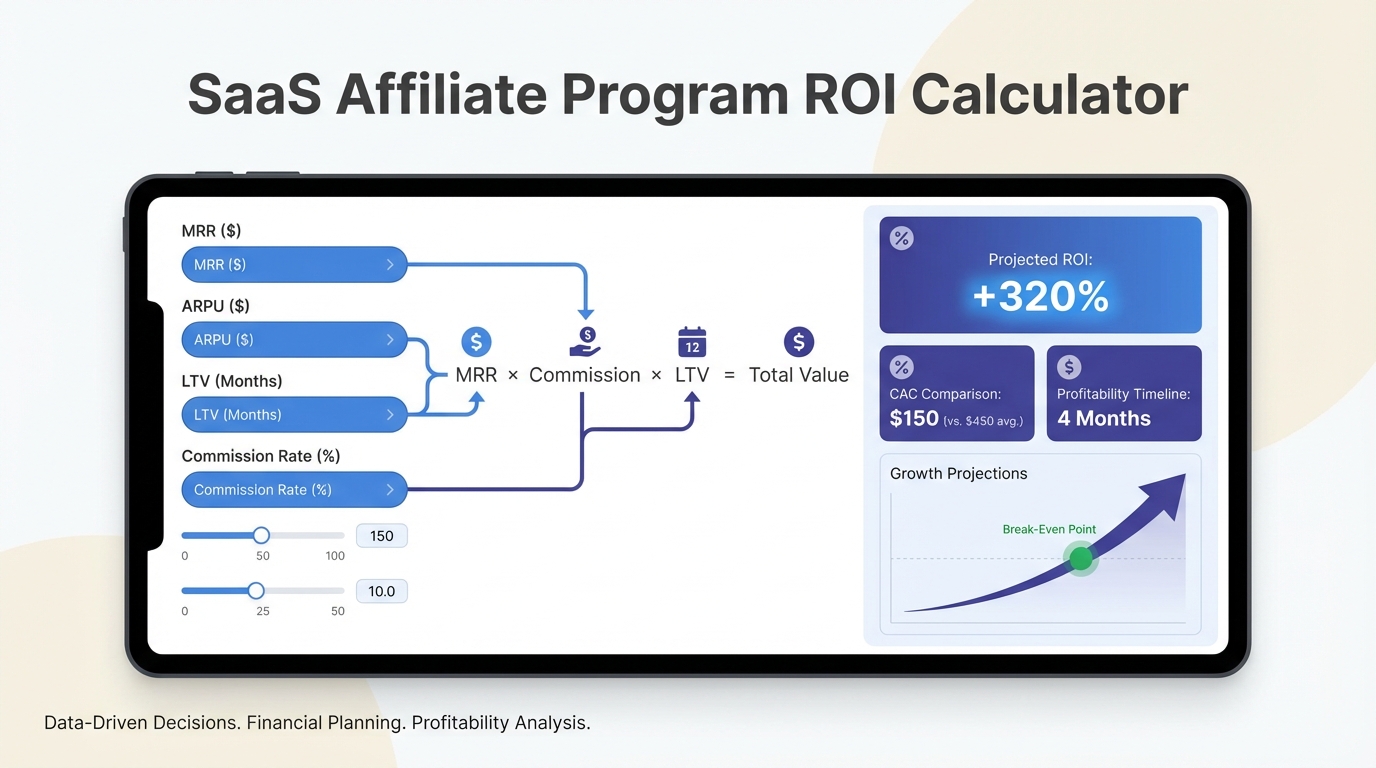

Interactive ROI Calculator

[CALCULATOR COMPONENT WILL BE EMBEDDED HERE]

The calculator will include input fields for:

- Current MRR

- ARPU ($/month)

- Average customer lifetime (months)

- Current CAC ($)

- Monthly new customers

- Proposed commission % (or flat rate)

- Commission type (one-time, recurring 12mo, recurring 24mo, lifetime)

- Expected % of customers from affiliates

- Affiliate software cost ($/month)

Output displays:

- Customer Lifetime Value (LTV)

- Total affiliate commission per customer

- Effective affiliate CAC

- LTV:CAC ratio (affiliate channel)

- Monthly affiliate revenue projection

- Monthly commission payout

- Net profit from affiliate channel (12 months)

- Break-even month

- ROI percentage (12 months)

Understanding Your Results

Once you've plugged in your numbers, you're looking at a projection of what an affiliate program might deliver for your business. But raw numbers only tell part of the story. Here's how to interpret what you're seeing and whether it signals a green light or a red flag.

What "Good" Looks Like

Affiliate CAC significantly lower than current CAC. If your effective affiliate CAC comes out to less than 50% of your current customer acquisition cost, that's a strong signal. You're acquiring customers through affiliates more efficiently than your existing channels. This doesn't mean you should abandon paid ads or content marketing—it means affiliates could meaningfully improve your overall CAC by diversifying your acquisition mix.

For example, if your current CAC is $200 and the calculator shows an affiliate CAC of $90, you're looking at a 55% reduction. That's worth pursuing, even if affiliate volume starts small.

LTV:CAC ratio of 3:1 or better on the affiliate channel. SaaS unit economics fundamentals still apply. Take your customer lifetime value (ARPU × customer lifetime in months) and divide it by your projected affiliate CAC. If that ratio is 3:1 or higher, your affiliate channel is economically sustainable. Anything above 4:1 means you're leaving money on the table—you could likely afford higher commission rates to attract more affiliates.

Positive ROI within 6 months. An affiliate program doesn't need to be profitable from day one, but it shouldn't take forever to break even either. If the calculator shows you'll recoup your software costs and commission payouts within six months, the program is worth pursuing. Beyond the six-month mark, you're in pure profit territory while simultaneously building long-term partner relationships.

Red Flags: When to Reconsider

Affiliate CAC higher than your current CAC. If the numbers show your affiliate CAC exceeding what you already pay to acquire customers, something's off. Usually, this means your proposed commission rate is too high relative to your ARPU and customer lifetime. Try adjusting the commission percentage down or switching from recurring to one-time commissions.

Negative 12-month ROI. If the calculator projects you'll be in the red after a full year of running the program, pause and rethink your structure. This usually happens when commission rates are generous but expected affiliate volume is too low to offset software and management costs. Either your commissions are too high, or your expectations about affiliate participation are too optimistic.

Break-even beyond 18 months. An affiliate program that takes more than 18 months to break even might technically be viable, but it's probably not your best use of time and resources right now. Focus on channels with faster payback periods, then revisit affiliates once you have more revenue and runway.

The Gray Zone: "Need More Data"

Sometimes the calculator will land in the middle—ROI is positive but modest, affiliate CAC is comparable to current CAC, or the projections are sensitive to small changes in assumptions. This is common, and it means you need to test in the real world.

Consider running a small pilot program. Launch with 10-20 hand-picked affiliates, track actual performance for 90 days, then plug those real numbers back into the calculator. Early-stage assumptions are just that—assumptions. Real data beats projections every time.

Scenarios: ROI Across Different Business Models

Let's walk through three realistic scenarios to show how affiliate program economics shift based on your pricing and business model. These examples use actual numbers from SaaS companies.

Scenario 1: Low-Ticket SaaS ($29/month ARPU)

The Setup:

- ARPU: $29/month

- Customer lifetime: 18 months

- Current CAC: $85

- Current monthly new customers: 50

The Challenge: With low absolute revenue per customer, you're working with thin margins. A $29/month customer generates $522 in lifetime value ($29 × 18). After subtracting your $85 CAC, you're left with $437 in lifetime profit per customer—healthy enough, but not much room for generous commissions.

The Math: If you offer 20% recurring commissions for 12 months, you're paying $69.60 per customer ($29 × 12 months × 20%). Add in $99/month for affiliate software, and you need substantial volume to break even. The calculator shows you'd need at least 15% of new customers to come from affiliates just to reach positive ROI in year one.

The Solution: Most successful low-ticket SaaS companies use one-time commissions instead. Offer 40-50% of the first month's revenue ($12-15 per signup). This keeps affiliate CAC low while still providing meaningful income for affiliates who drive volume. The key is attracting affiliates who can deliver scale—think YouTube creators with large audiences or niche bloggers with engaged communities.

Real Result: A project management tool at this price point runs 50% first-month commissions. They pay roughly $15 per signup, and affiliates drive 18% of new customers. Effective affiliate CAC: $78. Current CAC via paid ads: $102. The affiliate channel saves them 24% on acquisition costs while diversifying traffic sources.

Scenario 2: Mid-Ticket SaaS ($99/month ARPU)

The Setup:

- ARPU: $99/month

- Customer lifetime: 24 months

- Current CAC: $275

- Current monthly new customers: 40

The Sweet Spot: Mid-ticket SaaS is where affiliate programs really shine. You're generating $2,376 per customer over their lifetime ($99 × 24), which leaves room for generous recurring commissions while maintaining healthy margins.

The Math: At 25% recurring commissions for 12 months, you're paying $297 per customer ($99 × 12 × 25%). This is only slightly higher than your current CAC of $275, but remember—affiliates often bring higher-quality leads with better retention because of the trust factor. If affiliate-sourced customers stay even 2-3 months longer than average, the economics swing heavily in your favor.

The Structure: This price point attracts serious affiliate partners—consultants, agencies, and content creators who serve your target audience professionally. They're motivated by recurring income, not one-time payouts. A 25-30% recurring commission for 12 months is competitive and sustainable.

Real Result: A marketing automation platform at $99/month offers 30% recurring for 12 months ($356 per customer). Affiliates drive 22% of new signups. Effective affiliate CAC: $289. But here's the kicker: affiliate-sourced customers have a 28-month average lifetime versus 24 months overall. The extra four months of revenue ($396) more than covers the higher upfront CAC.

Scenario 3: High-Ticket SaaS ($299/month ARPU)

The Setup:

- ARPU: $299/month

- Customer lifetime: 30 months

- Current CAC: $950

- Current monthly new customers: 25

The Opportunity: At this tier, you can afford to be generous with commissions and still maintain excellent unit economics. A single customer generates $8,970 in lifetime revenue ($299 × 30 months). Even after a $950 CAC, you're looking at $8,020 in lifetime profit per customer.

The Math: Offer 20% lifetime recurring commissions, and you'll pay $1,794 per customer ($299 × 30 × 20%). Yes, that's nearly double your current CAC—but your LTV is so high that the math still works beautifully. Your LTV:CAC ratio remains above 5:1 even with generous affiliate payouts.

The Attraction: High-ticket affiliate programs attract professional partners who view your program as a meaningful revenue stream, not a side hustle. At 20% lifetime recurring, a single affiliate who drives just 5 customers per month earns $2,985 monthly in recurring commissions. That's enough to motivate serious promotional effort.

The Structure: Lifetime commissions are table stakes at this price point. Some high-ticket SaaS companies even offer 25-30% lifetime commissions because customer LTV is so substantial. The key is attracting a small number of high-performing affiliates rather than building a program with hundreds of casual participants.

Real Result: An enterprise CRM at $350/month offers 25% lifetime recurring. They have just 18 active affiliates, but those partners drive 28% of new customers. Effective affiliate CAC: $1,680. Much higher than their $950 average CAC, but affiliate customers are larger deals (multi-seat accounts) with 36-month average lifetimes. The actual LTV of affiliate customers is $12,600, maintaining a healthy 7.5:1 LTV:CAC ratio.

Beyond the Numbers: What the Calculator Can't Tell You

The calculator gives you hard ROI projections, but it can't capture everything that makes an affiliate program valuable. Some of the most important benefits aren't reflected in your first-year revenue numbers.

Brand Awareness and SEO Compound Over Time

Every affiliate who creates content about your product—whether it's a blog post, YouTube review, or social media thread—builds your brand presence and creates backlinks to your site. A single affiliate blog post comparing you to competitors might rank in Google for years, driving ongoing organic traffic long after you've stopped paying commissions on that particular customer.

We've seen SaaS companies gain 30-40 high-quality backlinks in the first year of running an affiliate program, contributing to improved domain authority and better organic rankings for competitive keywords. That SEO value isn't captured in the 12-month ROI calculation, but it's real and it's cumulative.

Customer Quality Often Exceeds Paid Channel Leads

Affiliate-sourced customers typically arrive more educated about your product and more committed to using it. They've read detailed content from a trusted source explaining why your solution is right for their specific use case. This means better onboarding completion rates, higher activation, and longer retention.

The calculator assumes affiliate customers have the same lifetime as your overall average. In reality, they often stay 10-20% longer because the pre-sale education reduces buyer's remorse and sets proper expectations.

Reduced Dependence on Paid Advertising

Every dollar of revenue from affiliates is a dollar that doesn't depend on Facebook's algorithm changes, Google's ad auction dynamics, or rising CPCs in your competitive keywords. Diversification itself has value, even if affiliate CAC equals paid channel CAC. You're building a more resilient acquisition engine that doesn't collapse if one channel becomes unprofitable overnight.

Long-Term Partner Relationships Create Compounding Returns

The best affiliate partnerships aren't transactional—they're relationships. An affiliate who promotes you successfully this year will likely promote you next year too, with even better results as their audience grows and their content library expands. The calculator models year one; it doesn't capture the compounding value of multi-year partnerships.

The Competitive Question

Here's the real question that goes beyond ROI calculations: "Can I afford NOT to have an affiliate program if my competitors do?" If your competition is capturing mindshare with key influencers and thought leaders in your space, being absent from those conversations costs you deals. Sometimes launching an affiliate program isn't about raw ROI—it's about maintaining competitive parity in how buyers discover and evaluate solutions.

Making the Decision: Next Steps Based on Your Results

Now that you've run the numbers and understand what they mean, here's how to move forward based on what the calculator told you.

If Your ROI Looks Strong (3:1+ LTV:CAC, positive ROI within 6 months)

You have a clear green light. Your business metrics support an affiliate program, and the economics are compelling. Your next steps:

- Finalize your commission structure. Use the commission rate that gave you the best ROI projections as your starting point. You can always test and optimize later.

- Choose your affiliate software. Don't let perfect be the enemy of good. Start with a platform that integrates with your payment processor (Stripe, Paddle) and tracks subscription lifecycle events properly. The calculator assumed $99/month in software costs—that's realistic for solid mid-market solutions.

- Recruit your first 10 affiliates manually. Don't wait to build a massive affiliate network. Identify 10 people who already use and love your product and have an audience that matches your ICP. Personal outreach to existing customers often converts 30-40% into active affiliates.

- Set a 90-day check-in. Launch, track real performance, then plug actual numbers back into this calculator. Your assumptions will be wrong (everyone's are)—but real data lets you optimize.

Ready to launch your affiliate program? Get started with a free trial and launch in under 15 minutes. Start Free Trial

If Your Numbers Are Borderline (Break-even around 12 months, affiliate CAC similar to current CAC)

You're in the "maybe" zone. The program isn't a slam dunk financially, but it's not a disaster either. This usually means one of three things:

- Your commission assumptions are slightly off. Try adjusting the rate up or down by 5% and see how projections change.

- Your affiliate volume expectations are too conservative or too optimistic. Reality might be different.

- Your business is in a transitional phase where the economics will look better in 6 months.

Your best move: Run a small pilot. Launch with 5-10 hand-picked affiliates and minimal software investment. Track performance for 90 days, then decide whether to scale or shut down. A pilot program costs you very little and gives you real data to make a confident decision.

Want help structuring a pilot program? Book a strategy call and we'll help you design a low-risk test. Schedule Call

If the Math Doesn't Work (Negative ROI, affiliate CAC higher than current CAC)

Don't launch yet. The calculator is telling you that based on your current metrics and assumptions, an affiliate program will lose money. That doesn't mean it will never make sense—it means the timing or structure isn't right.

Common fixes:

- Lower your commission rate. If you tested 30% recurring and got negative ROI, try 20% or switch to one-time commissions.

- Focus on improving your core metrics first. If your current CAC is already high and LTV is marginal, an affiliate program won't fix that. Improve retention and reduce churn first, then revisit affiliates.

- Wait until you have more scale. If you're doing fewer than 20 new customers per month, affiliate program overhead might not be worth it yet. Get to 50+ monthly signups, then recalculate.

The calculator isn't saying "never do affiliates"—it's saying "not with this structure at this stage." That's valuable information that could save you from a costly mistake.

Get Your Full ROI Report

Want to see how your numbers compare to industry benchmarks? We'll send you a detailed report showing:

- How your projected affiliate CAC compares to companies at your revenue stage

- Commission structure recommendations based on your ARPU tier

- Affiliate recruitment strategies that work for businesses like yours

- 90-day pilot program template

[EMAIL CAPTURE FORM]

- Name

- Company Name

- Current MRR (used for segmentation)

We'll segment the report based on your MRR and ARPU inputs to give you relevant comparisons and recommendations.

Key Metrics to Track Once You Launch

Once you've launched your affiliate program, these are the critical metrics to monitor:

Core Performance Metrics

| Metric | What It Measures | Target Benchmark |

|---|---|---|

| Affiliate CAC | Total commission + software cost ÷ customers acquired | 50-70% of your standard CAC |

| Affiliate Contribution % | % of new customers from affiliates | 15-30% for mature programs |

| Active Affiliate Rate | % of affiliates who drive at least 1 conversion | 20-40% (varies by recruitment quality) |

| Avg Revenue per Affiliate | Total commission paid ÷ active affiliates | Higher is better; top 20% drive 80% of results |

| LTV:CAC Ratio | Customer LTV ÷ Affiliate CAC | 3:1 minimum, 5:1+ ideal |

Quality Metrics

| Metric | What It Measures | What Good Looks Like |

|---|---|---|

| Trial-to-Paid Conversion | % of affiliate referrals that convert | Equal to or better than organic/paid |

| 90-Day Retention | % of affiliate customers still active at 90 days | Equal to or better than organic/paid |

| Avg Customer Lifetime | How long affiliate customers stay | 10-20% longer than other channels |

| Support Ticket Volume | Support requests per affiliate customer | Lower than paid channels (pre-educated) |

Program Health Metrics

| Metric | What It Measures | Action Triggers |

|---|---|---|

| Affiliate Churn | % of affiliates who stop promoting | >30% quarterly = investigate |

| Time to First Referral | Days from signup to first conversion | >60 days = onboarding issue |

| Clicks per Referral | Click volume needed for conversion | Rising = targeting problem |

| Top Affiliate Concentration | % of revenue from top 10 affiliates | >80% = recruitment over-dependence |

Track these monthly for the first 6 months, then quarterly once the program stabilizes.

The Bottom Line

An affiliate program isn't right for every SaaS business at every stage. But for companies with product-market fit, healthy unit economics, and room in their CAC budget for performance marketing, affiliates can be one of the highest-ROI growth channels you'll ever activate.

The calculator gives you a data-driven starting point. The next step is testing in the real world. Start small, track ruthlessly, and optimize based on actual performance. The best affiliate programs are built iteratively, not launched perfectly from day one.

What did your numbers tell you? Are you moving forward with an affiliate program, or does your business need to hit different metrics first? Either way, you're making a more informed decision than 95% of founders who launch affiliates based on gut feel and hope.

Related Resources: